RNC Pharma: Russian Consumers of Nebulizers Prefer Marketplaces to Pharmacies, Except in Far East

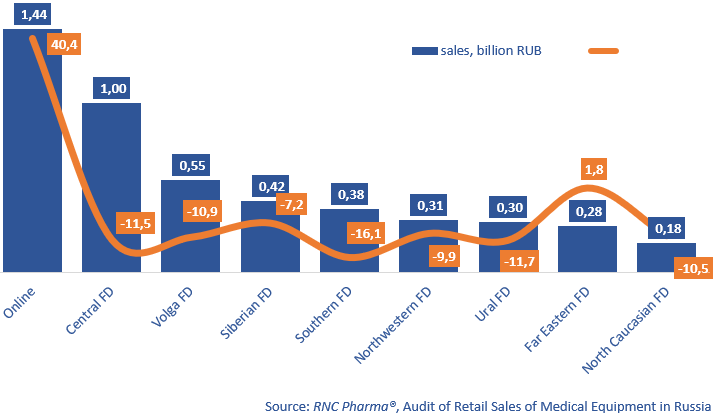

In 2023, 4.9 billion rubles’ worth of nebulizers were sold on the Russian retail market (retail prices, VAT included), up only 0.5% from 2022. At the same time, the sales in physical terms went up by as much as 9.6%. Online sales alone contributed to the total growth rates, with its 40.4% in monetary terms and 67.6% in physical terms. Offline sales, however, went down by 10.3% in rubles and by about 9.5% in units.

Marketplaces heavily influenced the market in all federal districts, except for the Far East, where around 87,300 devices were sold, up 0.4% from 2022, or 1.8% in rubles. Apparently, this is only temporary and is bound to change once the development of online infrastructure in the region is complete. The Southern Federal District saw the worth growth rates: offline sales went down 16.1% in monetary and down 16.3% in physical terms. The Siberian Federal District had the best growth rates, although still negative: sales decreased by 7.2% in monetary and by around 5% in physical terms.

PThe product range and prices differed from region to region. For example, the Far East sold the most expensive devices—around 3,160 rubles per device (retail prices, VAT included), followed by the Central Federal District (2,980 rubles) and the North Caucasus (2,920 rubles). The cheapest devices were sold in the Southern Federal District—for 2,660 per device. The cheapest devices could also be found online—for 1,960 rubles. Just like with blood pressure monitors, a lot of unbranded devices were sold online. In 2023, every second device sold online was unbranded, while they accounted for no more than 29% back in 2022.

Mainly compressor nebulizers were sold on the Russian offline and online markets, accounting for 89% of the sales in monetary and for around 86% in physical terms in 2023. At the same time, they were being actively replaced by ultrasonic devices, including mesh nebulizers. In particular, mesh nebulizers accounted for around 10% of the sales in monetary and for 15% in physical terms. There are also steam inhalers, in particular, classic Romashka-2 and Romashka-3, but those are considered niche, which is why the sales are falling.

Devices by Omron (Japan) and B.Well (Switzerland) were the most sold compressor nebulizers in monetary and physical terms, respectively. However, the sales of both brands went down, by 17% by 4% in rubles, respectively. Omron and B.Well are followed by A&D (Japan) and Little Doctor (Singapore); the sales here, on the contrary, went up by 14% and by 16%. CN-123 contributed to the growth rates of the Japanese manufacturer, while LD-220C helped increase the growth rates of Singaporean company.

As for ultrasonic nebulizers, the most sold devices were unbranded, with the sales going up multiple times against 2023. They are followed by Glenmark Impex and Xiaomi Technology, with growth rates of 43% and 57%, respectively. Nebzmart MBPN002 and NB8 contributed to the growth rates of the companies the most.

Fig. 1. Volume and growth rates of the retail sales of nebulizers in Russian federal districts in 2023 (retail prices, VAT included)

Рус

Рус