RNC Pharma: Top Russian Pharma Wholesaler Changed, Concentration Ratios Dropped

In early 2023, the Russian pharmaceutical wholesale market saw rather significant changes. First, Puls, having cleared up their client database, lost two positions in the rankings, dropping to 3rd place. Nothing surprising here for the pharmaceutical market, since nearly every major market participant has gone through database cleansing and subsequent ranking drops at one time. Second, concentration ratios dropped—the total share of top distributors fell 11%, since most of the larger wholesalers tend to work with retailers, and retail sales this year decreased, as expected. However, retail sales in Q1 2023 fell by only 6.3% from Q1 2022, meaning that the pharmaceutical retail is looking good—sales seem to be finally going up rather than plummet (if you do not count the abnormal spring 2022). In addition, household incomes in Q1 2023 went slightly up compared to Q1 2022, and the inflation rates in March–April 2023 did not exceed 1–2%—the market is recovering even faster than was predicted in late 2022.

Yet, certain risks do remain. For example, Johnson & Johnson announced it would suspend exports of contact lenses to Russia in late spring, causing some concern. Since the company is the market leader, with a share of about 50% in monetary terms, the possible consequences were quite clear. With the market in panic, we saw a repeat of last year’s spring crisis. The regulators even promised to add alternative brands to the list of products for parallel imports as soon as possible, but Johnson & Johnson was quick to announce that it would resume exports soon. Apart from some short-lived panic, the episode did not cause major problems.

Another consequence of the sanctions is reports of Takeda selling its production assets in Russia have been circulating in the market for several months. Considering that several large foreign companies, in particular BMS and Eli Lilly, stopped exporting non-essential medicines to Russia at once, the reports might be true. Another interesting fact is that R-Pharm is reported to be among the possible buyers. While we cannot comment on rumors, this particular one fits into the company’s strategy for developing its production.

As for less positive news, creditors have filed several lawsuits to declare the distributor Profitmed bankrupt since the beginning of the year, and in late May the court introduced supervision of the company. Given the circumstances, bankruptcy does not seem impossible. Another potential candidate for bankruptcy is the distribution division of Biotec. This case is also interesting in that the company has been transferred to trust management by Dmitry Rutskoi, who has an unusual task to bring the group’s viable assets out of the crisis.

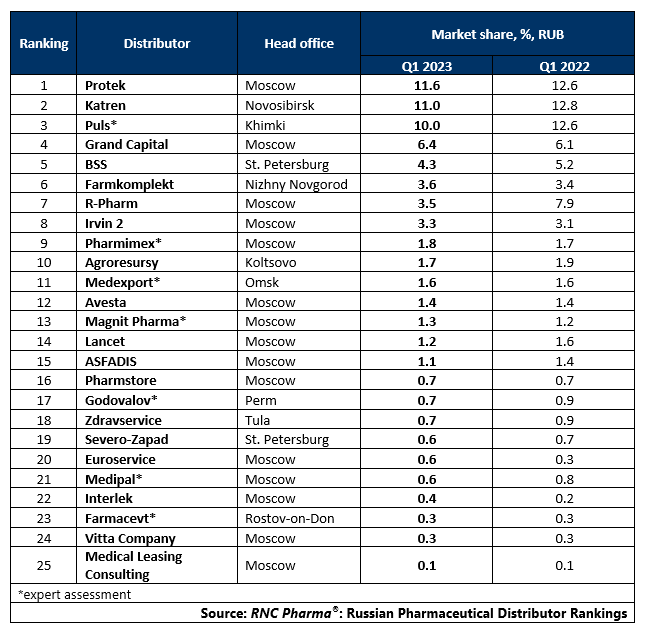

Tab. Top 25 pharmaceutical distributors with the largest market shares of direct pharmaceutical drug supplies (including preferential supplies), in monetary terms in Q1 2023

Рус

Рус