Database Update: Import of Veterinary Drugs, Feed Supplements, and Veterinary APIs to Russia (February 2020)

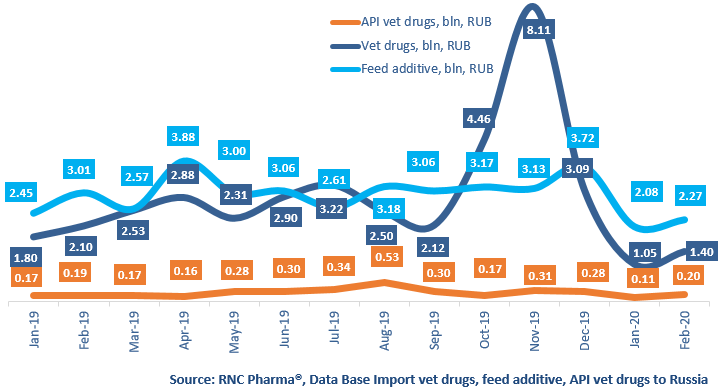

Between January and February 2020, Russia imported 2.46 bln RUB worth of veterinary drugs (customs clearance prices), which is monetary terms (rubles) 37% lower than that of the same period in 2019. The import volume of feed supplements amounted to 4.35 bln RUB, with the dynamics of -20%. As for veterinary APIs, the import volume is 306 mln RUB, and the dynamics are -14%.

The dynamics of the import of veterinary drugs in physical terms (units) are -29%, with 3 mln units. The import volume of feed supplements are 1.3 mln units, with the dynamics of -17%. Only the dynamics of the veterinary API import are positive, +8%, with 164 tons.

Despite the negative dynamics overall, the top 15 companies with the largest import volume of veterinary drugs include several companies that have increased their imports. Dox-al (Italy) and Syva Laboratorios (Spain) have the highest dynamics, their imports grown by 4 times in monetary terms. Dox-al imported three veterinary drugs to Russia: antibiotics for farm animals Amoxiprom, Doximix, and Noxigard, and Syva imported mostly antibacterials, with Amoxoil having the highest dynamics (imports grown by 51 times).

As for the top manufacturers of feed supplements, Ajinomoto Group (France) has the highest dynamics (imports grown by 20.5 times in monetary terms). It imported three amino acids to Russia: L-Lysine Hydrochloride, L-Tryptophan, and L-Valine. The French company is followed by Lallemand Animal Nutrition (Great Britain), imports increased by 7 times. The company also imported three products to Russia, with rumen specific live yeast Levucell accounting for the largest import volume.

Henan Kangtai Pharmaceutical (China) has the highest dynamics of the veterinary API import. The company did not import to Russia in 2019, but this year it imported Norfloxacin Hydrochloride, which amounted to 23.2 mln RUB. Among those companies that imported to Russia in 2019, Sinopharm Weiqida Pharmaceutical (China) has the highest dynamics, imports grown by 3.8 times. The company imported antibacterials Amoxicillin Trihydrate and its combinations with Clavulanate Potassium.

Dynamics of import of veterinary drugs, feed supplements, and veterinary APIs to Russia (EEU countries excluded), customs clearance prices, VAT included, bln RUB (January 2019 – February 2020)

Рус

Рус