Ranking of Russian Pharmacy Chains (Q1–Q3 2021)

This year’s growth rates of the Russian pharmaceutical retail market are in no way comparable to those in 2020. The panic and the associated rush demand have more or less subsided. With the inflation rates at a high level, the purchasing power leaves much to be desired, even despite the impressive income growth in Q2 and Q3. In addition, conventional pharmacies are under severe pressure from various online projects, which have been adding more and more services, including express delivery, which in some situations is critical for the consumer.

Meanwhile, a much more revolutionary innovation has been in the works for the online retail—the experimental sale of prescription drugs. Notably, the initiative is being lobbied from below, and so far has been introduced only in Moscow and Belgorod Oblast. Both regions are independent in this matter. The corresponding documents include a number of significant restrictions on allowing the sale of prescription drugs for certain players, and both have been sent for revision after receiving negative feedback from the regulators. That is why the experiment is expected to start no sooner than next year, and its results can be assessed as late as in 2023. However, even with a positive outcome of the experiment, scaling up the process throughout the country will be practically impossible without an established federal system of electronic prescriptions.

The lawmakers are going to continue working on a document that would limit the regional expansion of pharmacy chains and back margin possibilities for them. If the industry is not able to find something to counterbalance it, the market will have to experience further shocks, since the proposed rules would directly affect the pricing policy of pharmaceutical companies, which means that they would also affect demand, and not for the better. Unfortunately, there seems to be hardly any opportunity for counterbalance, and the most realistic option is to expand the range of drugs allowed for sale in pharmacies, although even this could take years. So far, most of retailers have relied on the Rx assortment, often preferring it to parapharmaceuticals. There is also positive news—Moscow has announced the launch of a pilot project, which allow private pharmacies into the system of preferential drug provision. However, this is not only about access to a multi-billion dollar market or more affordable drug care. The initiative contains some elements of co-payment, which means that the customer will be able to receive a product of their choice after paying a surcharge in the form of the price difference, if for some reason they are not satisfied with the free product.

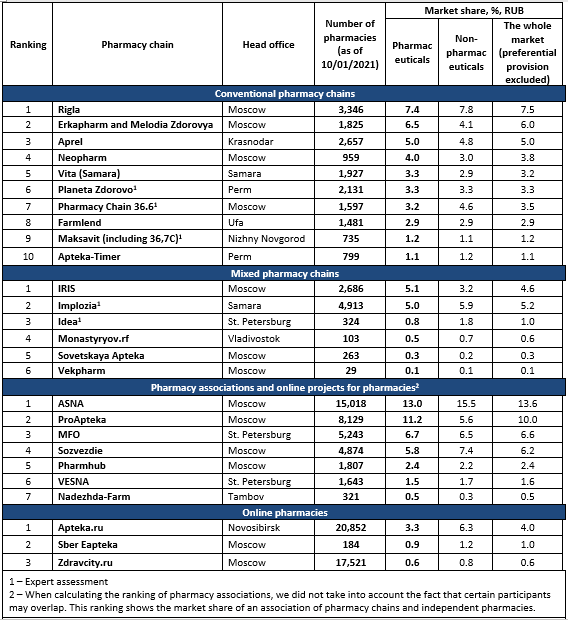

Tab. Top pharmacy chains in the Russian pharmaceutical retail market (Q1–Q3 2021)

Рус

Рус