RNC Pharma: Most Expensive Glucose Meters Sold in North Caucasus, Most Expensive Test Strips in Far East

In 2023, 1.38 million glucose meters and around 657.3 million glucose test strips were sold on the Russian retail market, down 0.3% and 3.5% from 2022, respectively. The drop can be explained by the rush demand in 2022, when sanctions were imposed, leading to an inflated base in the comparison period. 1.45 billion rubles’ worth of glucometers and around 10.3 billion rubles’ worth of glucose test strips were sold (retail prices, VAT included). With glucometers becoming noticeably more expensive in 2023, the sales grew 11.6%. However, the sales of test strips went down 0.3% from 2022.

Just like with other types of medical equipment, online sales increased multiple times against 2022; the sales of glucose meters and glucose test strips went up 2.8 and 2.2 times in monetary terms, respectively. At the same time, the offline sales of both glucometers and test strips fell by about 6%. The share of the online sales of glucometers grew nearly 2.5 times against 2022; in 2023, 24.3% of all glucometers in monetary terms were sold online. As for test strips, while consumers prefer pharmacies—online sales accounted for only 9.4%, the share still grew 2.2 times against 2022.

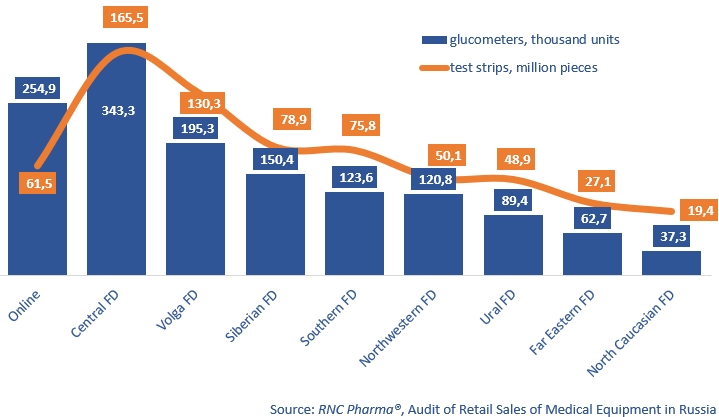

Offline sales differed from region to region, both in terms of product range and growth rates. As for glucose meters, the sales in physical terms dropped in all federal districts. The Ural and Central Federal Districts saw the most pronounced decline—the sales fell 14% and 13%, respectively. The sales in monetary terms increased only in two districts—the Far East and the North Caucasus. The latter also had the highest average price—around 1,200 rubles per device.

The sales of test strips decreased in all regions, both in monetary and physical terms. The Southern and Far Eastern Federal Districts saw the smallest decrease—the sales fell 3% and 4%, respectively. Interestingly, the highest average price per test strip is found in the Far Eastern Federal District—around 20 rubles per strip, whereas the lowest price is in the Volga Federal District—a little more than 13 rubles per strip. The sales in monetary terms fell in all regions; the North-Western and Central Federal Districts saw the worst growth rates—down 10% and 8%, respectively.

Russian Elta sold the most glucose meters in monetary terms, while in physical terms, the company is in the third place. Johnson & Johnson had the largest sales in physical terms; the company’s sales in 2023 also grew 45% from 2022. Chinese Microtech Medical had the best growth rates in physical terms—its sales in 2023 went up 10.2 times against 2022. Roche sold the most test strips both in monetary and physical terms, even though the company’s sales fell 19%. While Elta is in the fourth place in terms of sales in rubles, the company’s sales in physical terms helped it get to the second place. American Acon Laboratories had the best growth rates in physical terms—its sales went up 90% from 2022.

Fig. 1. Sales of glucose meters and glucose test strips in physical terms in Russian federal districts in 2023

Рус

Рус