RNC Pharma: Share of US Veterinary Manufacturers in Retail Market Drops 6%

In 2023, 35.4 billion rubles’ worth of veterinary drugs were sold on the Russian retail market (retail prices, VAT included), up 22.5% from 2022, which is record-worthy. In physical terms, 235 million minimum dosage units (MDU) were sold, up 13%. The difference in growth rates can be easily explained by the inflation rate. Interestingly, the online market continued to actively develop—online sales went up 2.2 times in MDUs, while offline sales grew by only 5%.

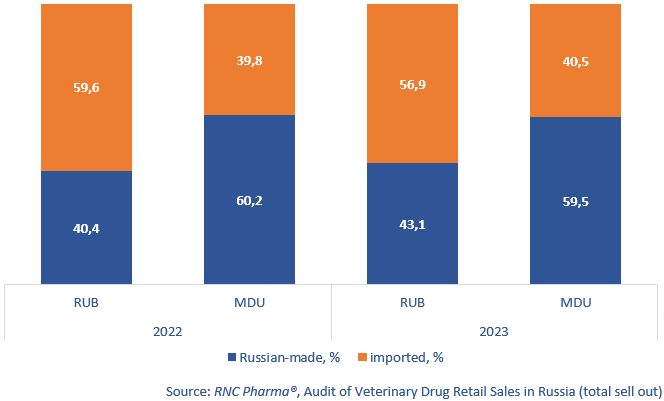

The veterinary market saw important changes in terms of structure; in particular, the ratio of imported and Russian companies was rapidly changing. The sales of Russian-made products grew 30.8% in monetary terms, which heavily influenced the overall growth rates. The growth rates of Russia companies in physical terms, although positive, were below the market average (up 11.7%). This was the result of the fact that manufacturers chose to promote modern drugs of above-average prices more actively, often at the cost of reducing sales of some older drugs. The high growth rates of Russian companies led to a noticeable increase in the share of Russian players in monetary terms—43.1%, up 2.7% from 2022. In physical terms, however, the sales went down 0.7%, with Russian-made products accounting for 59.5% of the total sales.

American manufacturers saw the biggest losses—their share in monetary terms fell 6.3%, to 31.2%. The drop could have been even more pronounced, since some drugs are parallel-imported. The share of France and Germany also decreased—by 0.9% and 0.6%, respectively. At the same, the share of Czech manufacturers grew even more than that of Russian companies, reaching 4.4%, up 2.9% from 2022. The share of Slovenian companies went up 1.8%, to 7%.

Favorite had the best growth rates in monetary terms among the top 20 Russian companies. Its sales went up 54%, with the repellent shampoo for cats and dogs Good Dog & Cat contributing to the growth rates the most. Favorite is followed by is Biogard with 51%; its repellents Miss Kiss and Mr. Bruno helped the company’s growth rates. Both Agrobioprom and Ecoprom had comparable growth rates: 49% and 41%, respectively.

As for foreign veterinary manufacturers, the long-term leader, MSD, is no longer in the first place. After imports of a number of its products were ceased, the company is now third, leaving the first place to Zoetis. Bioveta (Czechia) and Laboratorios Karizoo (Spain) had the best growth rates among the top 20 companies—the sales of both companies increased 4.6 times against 2022. The Czech company actively sold vaccines, including those types that MSD used to import, while the Spanish manufacturer increased sales of Uristop, drug for urinary incontinence in dogs.

Fig, 1. Structure of the Russian veterinary retail market, by country, in 2022–2023

Рус

Рус