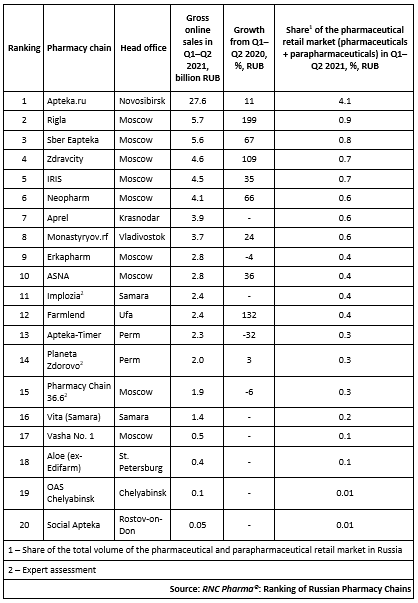

Top 20 Online Pharmaceutical Retailers in Russia (Q1–Q2 2021)

From January to June 2021, the total volume of the online sales or reservation of pharmacy products (pharmaceutical drugs and parapharmaceuticals) in Russia amounted to 94.2 million rubles (end-user prices, VAT included), 28.5% up from the first two quarters of 2020, while the total growth rates of the Russian pharmaceutical retail for the period could not get out of the negative zone (-0.5%). Even that would not have been possible without Rx drugs, which are not yet allowed to be sold online. The growth rates of the sales of the other product groups are -5.9%. The share of e-com sales in the total volume of Russian pharmaceutical retail increases due to the outstripping growth rates, amounting to 14%*, 3.2% higher than a year earlier.

The total revenue of the top 20 companies for the period amounted to 75.5 billion rubles (end user prices prices, VAT included)—80% of the total transaction volume in the Russian e-com segment. However, the share of the top companies continued to decline, despite the impressive growth rates most of them demonstrated. As of now, the growth rates demonstrated by companies outside the top 20 are higher, but this will be maintained as long as there is an active flow of customers from the offline—then they will have to compete with larger online retailers, with hardly any hope for the same outstripping growth rates, especially since a big number of marketplaces entered the pharmaceutical market on September 1.

Apteka.ru is the leader of the pharmaceutical e-com segment, with the share of 4.1% of the market (parapharmaceuticals included). Still, the company’s growth rates are much lower than the average rates in the segment, +11% in rubles. However, the company set a kind of record during the first half of 2021, adding nearly 4,500 pharmacies, which will undoubtedly lead to a higher number of transactions.Many more partners joining pharmacy associations has become a feature of this period, with ASNA (+2,100 pharmacies), ZdravCity (+2,400 pharmacies) and other structures following the trend. The latter, by the way, has one of the best growth rates in rubles, +109%.

Rigla has the highest growth rates for the period, tripling its transaction volume and placing second in the ranking. Farmlend (+132%) also has impressive sales growth rates in the top 20.

Top 3 Sber Eapteka, apart from its significant growth rates of +67%, has been actively scaling up its activities by entering new regions. The number of regions where it operates has almost tripled over the past six months; as of July 1, 2021, it amounted to 44 federal subjects. In addition, it continued to develop offline by expanding the number of pharmacies. Neopharm has almost the same growth rates (+66%), but they increased their transaction volume without geographical expansion, unlike Sber Eapteka.

Тop 20 Russian online pharmaceutical retailers in Q1–Q2 2021**

* Only organizations specializing in the sale of medicinal products were included in the ranking. The volumes mentioned do not include the revenue of representatives of the gray online business supplying original drugs to Russia from other countries and services selling generics unregistered in Russia

** OZON (www.ozon.ru) was excluded from the ranking due to its refusal to provide the data required

Рус

Рус