RNC Pharma: Analog Mercury Thermometers Most Stable in Demand in 2023

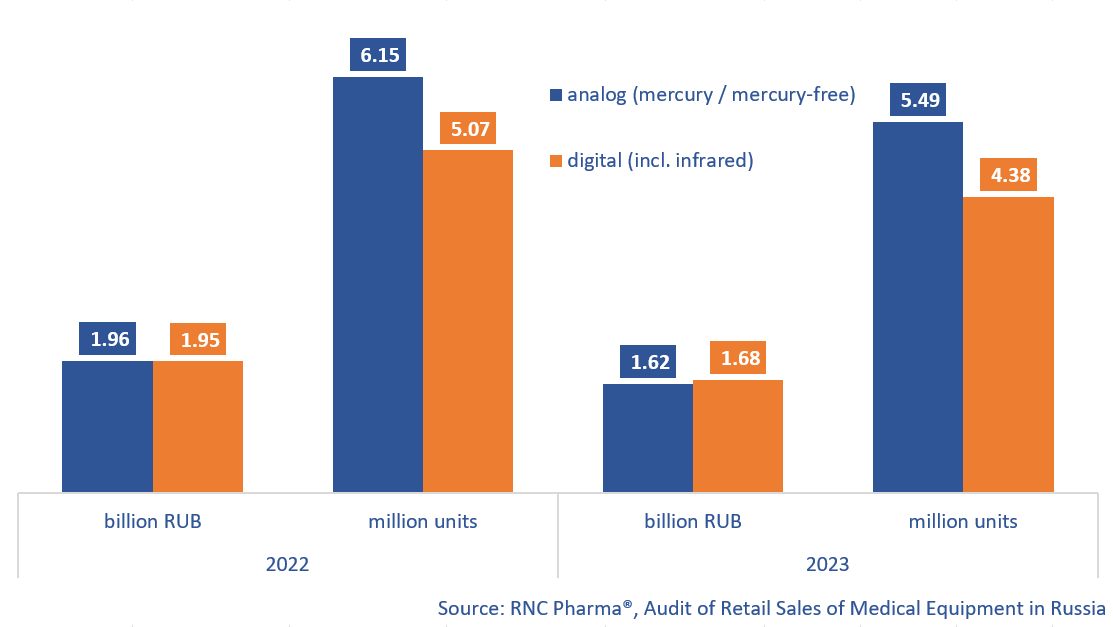

In 2023, 9.9 million medical thermometers worth 3.3 billion rubles (retail prices, VAT included) were sold on the Russian retail market (online sales included), down 12% in physical and down 15.7% in monetary terms from 2022. Falling demand in the offline segment is the one to blame here; the offline sales decreased by 19% in rubles and by 15% in units. While the online sales grew both in rubles (by 16%) and in units (by 23%), the sales volume was relatively small, accounting for only 11% of the total sales, not enough to ensure the positive growth rates of the device.

There are two main categories of medical thermometers on the market: analog and digital, both of which saw declining demand in 2023. In physical terms, the sales of analog thermometers went down 10.8% from 2022, while those of digital devices fell 13.5%. Interestingly, analog thermometers fell in price in 2023 by 7.4%, while the average price for digital ones remained almost the same, going down by only 0.6%. Digital thermometers can be divided into contact and infrared devices; the consumption trends for both categories were practically the same in 2023, with the demand falling almost simultaneously. Analog devices are divided into mercury and mercury-free (or based on metal alloys: gallium, indium and tin). In 2023, only the sales of mercury thermometers went up, by 0.2% in units. Unlike mercury-free devices, mercury thermometers are easy to shake down; as a result, consumers preferred them to safer alternatives, even though the latter are around 15% cheaper.

As for digital thermometers, the absolute leaders in sales volume in monetary terms are products by A&D and B.Well (with a difference of 6 million rubles). At the same time, both companies saw their sales fall by 8% and 3%, respectively. In physical terms, however, A&D sold almost 200,000 more devices in 2023. Cofoe Technology Development (China) had the best growth rates in monetary terms—its sales increased 9 times against 2022. In Russia, the company sells KF-HW-001 infrared thermometers. Cofoe Technology Development is followed by German Braun—its sales grew nearly 5 times against 2022. The company’s product range is significantly wider; non-contact thermometers, in particular IRT6520 ThermoScan 7, contributed to the growth rates the most.

Most of analog thermometers on the market are unbranded, accounting for about 69% of the sales. While unbranded devices are sold both online and offline, their share in the offline segment is still somewhat lower. As for brands, British Meridian Medical Products had the largest sales volume in monetary terms, followed by Russian Termopribor (with a difference of 1.3 million rubles). The sales of both companies fell—by 1% and by 4%, respectively. Amrus saw the highest growth rates—its sales of analog thermometers went up 39% from 2022. TVY-130 contributed to the growth rates the most.

Fig. Sales of medical thermometers on the Russian retail market in monetary (rubles, retail prices, VAT included) and physical terms (units)

Рус

Рус