RNC Pharma: Market Share of Top Russian Pharma Distributors Grows

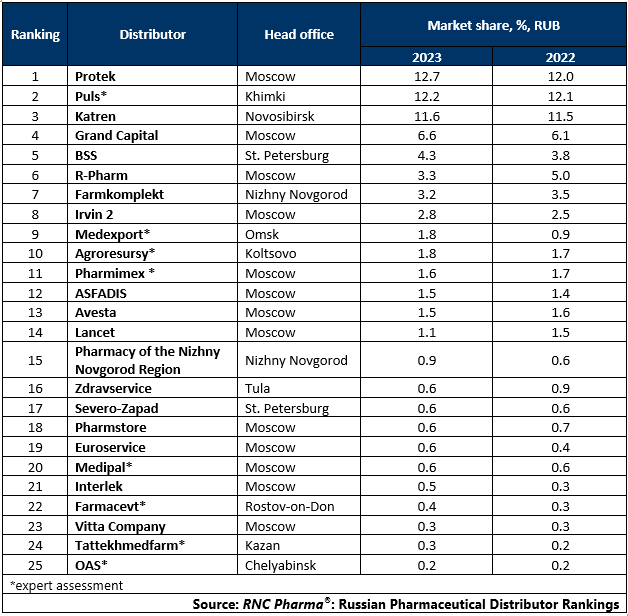

Last year, the Russian pharmaceutical market grew by 4.7% (in rubles). However, this result is difficult to call outstanding, with the average annual inflation of 6.1%. Still, the situation differed from segment to segment. In retail, the growth rates exceeded inflation, reaching nearly 7.7%, while the public sector went through stagnation—public procurements last year went down 0.2%. Those growth rates influenced the development indicators of wholesalers in the ranking, since their specialization is fairly clear. The share of the top 5 companies in 2023 went up by as much as 1.8% from 2022. At the same time, the share of the companies from #6 to #25 in 2023 decreased by approximately 0.6%.

Three factors contributed to the growth of the 5 largest companies. First, a steady increase in demand in retail, which showed an increase in consumer activity, despite being mostly inflationary in nature. Second, the top players have mostly updated their client portfolios, completing the process that has been going on for the past few years. At the same time, the process of tightening relations between wholesale and retail continues, and most distributors note a better payment discipline in the pharmaceutical retail market. Finally, market participants have been actively taking up the market share of those wholesalers that exited the market in 2023. Their market share exceeded 3%, but the shift is not complete yet.

Godovalov was one of the last distributors to leave the market in 2023; in early January 2024, the court declared the company bankrupt and began bankruptcy proceedings, which involves sale of property. In the same month, Boris Shpigel, the founder and owner of Biotec, who had been under arrest for several years, was finally given a sentence. As a result, several warehouse premises, manufacturing assets, and a number of retail assets will change ownership. Certain wholesalers may wish to expand their presence by purchasing regional warehouses; in particular, new countrywide players are already taking up the property previously owned by Apteka Ot Sklada. Production assets may also be of interest to those wholesalers that in 2023 actively invested in manufacture, including manufacture of pharmaceutical substances.

E-commerce, another important aspect of the wholesale, is not likely to develop this year. Pharmaceutical e-com entered a period of stagnation in 2023, which is unlikely to end without regulatory changes in the next couple of years. That is why most large wholesalers changed their investment strategies; last year, they focused on the development of warehouse infrastructure and related areas, including production.

Tab. Top 25 pharmaceutical distributors with the largest market shares of direct pharmaceutical drug supplies (including preferential supplies), in monetary terms in 2023

Рус

Рус