Inflation Rates in the Russian Pharmaceutical Retail Market in 2023

In 2023, veterinary drugs on the Russian retail market (e-com included) went up in price 26.6% from 2022. The highest price growth rates were seen in early 2023 (Fig. 1); as a result of the devaluation of the ruble and the subsequent correction of prices for imported goods on the Russian market, inflation surged in June–August 2023. By the end of the year, the prices had stabilized, with the inflation rate dropping to a year-low of 20.8% in late November 2023. December 2023, however, saw a slight upward trend; the price index was 21.3% from December 2022.

Fig. 1. Inflation rates* in the veterinary retail market in 2023

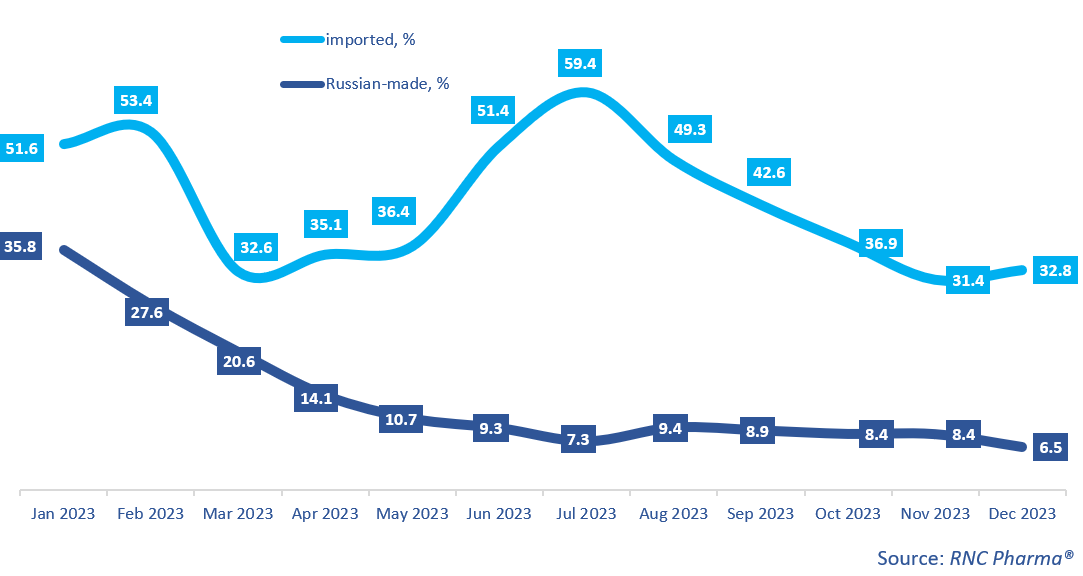

The growth rates of prices for imported and Russian-made drugs differed significantly; the average price for foreign products in 2023 grew 36.6% from 2022, while that for Russian-made goods went up by only 11.6% (Fig. 2). The prices for foreign products went up in the spring and summer; the prices peaked in July at 59.4%. At the same time, the growth rates of prices for imported goods determined the growth rates in the whole market and were heavily influenced by the situation in the foreign exchange market, especially when parallel imports were involved.

The inflation rate for Russian-made drugs in the analyzed period had a clear downward trend. It peaked in January 2023 at 35.8%, reaching a comfortable 10.7% in May 2023 before dropping to its lowest in October–November 2023 (8.4%). This trend continued in December, with the prices for veterinary drugs produced in Russia increasing by only 6.5% from December 2022.

Fig. 2. Inflation rates* in the veterinary retail market in 2023 (imported / Russian-made)

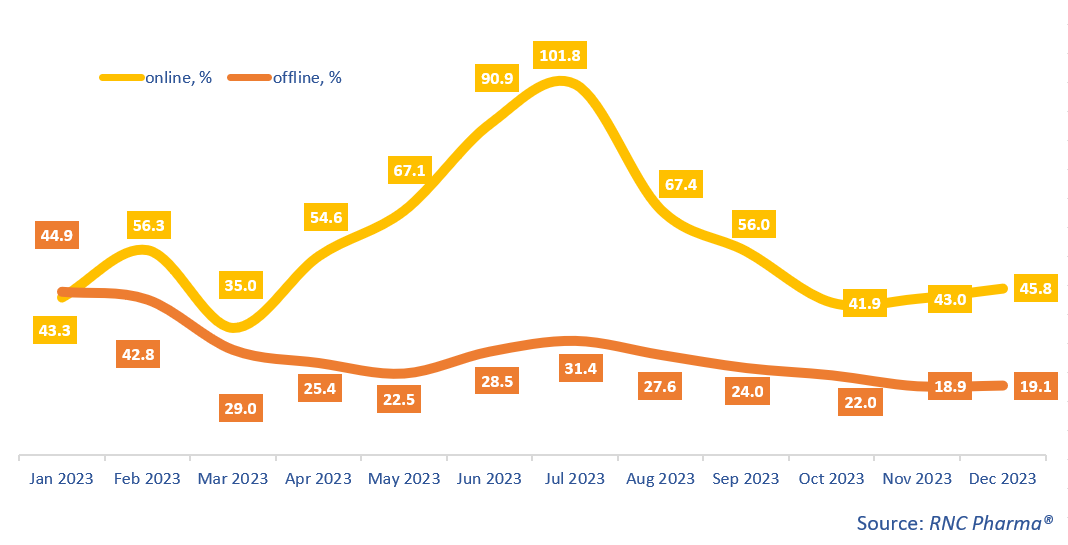

The inflation rate in the offline market was higher than that in the online segment only once, at 44.9% in January 2023. After that, the inflation rate went down, reaching its lowest at 18.9% in November 2023. In December, however, it went up once again, to 19.1% The inflation rate in the online market peaked twice: at 56.3% in February 2023, and at 101.8% in July 2023.

Fig. 3. Inflation rates* in the veterinary retail market in 2023 (online / offline)

Рус

Рус