RNC Pharma: Development Opportunities for Larger and Smaller Pharmaceutical Retailers Segregated, Development of Online Segment Halted

Market participants were significantly less active in early 2023 than during the rush demand in the spring of 2022. However, both inflation rates and stable household incomes now allow us to make optimistic industry growth forecasts, at least in the short term. Nevertheless, there are clear trends of a certain segregation in the market. It was mainly federal and certain multi-regional companies that could boast of developed infrastructure and high growth rates. Pharmacy associations also had noticeable growth rates, while many of the smaller companies were not able to achieve such results.

Russian lawmakers have been preparing additional risks for the market—they returned to the idea of limiting marketing benefits after nearly 3 years. Marketing is a very sensitive area for the Russian pharmaceutical retail, since in modern conditions it allows further development of the pharmacy infrastructure and helps adjust retail pharmaceutical prices. For those who are at least somehow familiar with the economics of pharmacies, it is obvious that limiting marketing benefits will result in higher prices and infrastructure degradation. That might make the relations between retailers and manufacturers fairer, but all market participants will have to go through a phase of shock first, which will obviously bring negative social consequences, in addition to consequences for business interests.

An apt example of the influence of regulators here is an experimental online sale of prescription drugs. It has formally been launched, but, several months in, it looks more like another futile attempt to breathe life into this monster of Dr. Frankenstein than a pilot project, since the total number of transactions leaves much to be desired. Meanwhile, the online segment of the Russian pharmaceutical market, having previously demonstrated growth rates that were many times as fast as the market development, has entered a phase of stagnation. Most of the wholesalers and retailers that have heavily invested in e-commerce have put it on hold and are opting for types of development with clearer prospects. While certain market players are continuing to develop the online segment even under the current conditions, they cannot change the whole situation.

Finally, the number of wholesalers focused on pharmaceutical retail is reducing. First ProfitMed stopped any retail operations in early 2023, then Magnit Pharma announced the impending closure of the business. That is a sign of not only a very clear trend associated with the general state of the Russian pharmaceutical wholesale, but also of another wave of restrictions for distributors working with retail.

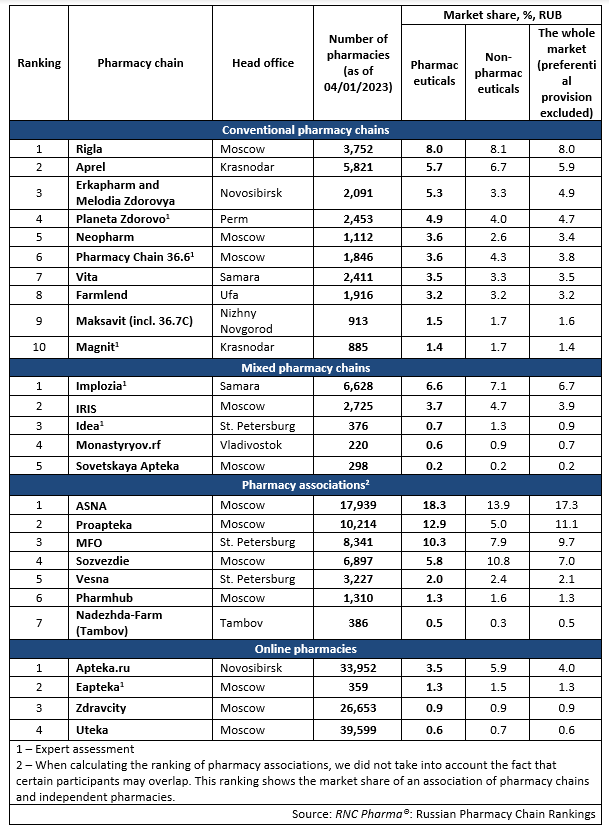

Tab. Top pharmacy chains in the Russian pharmaceutical retail market (Q1 2023)

Рус

Рус