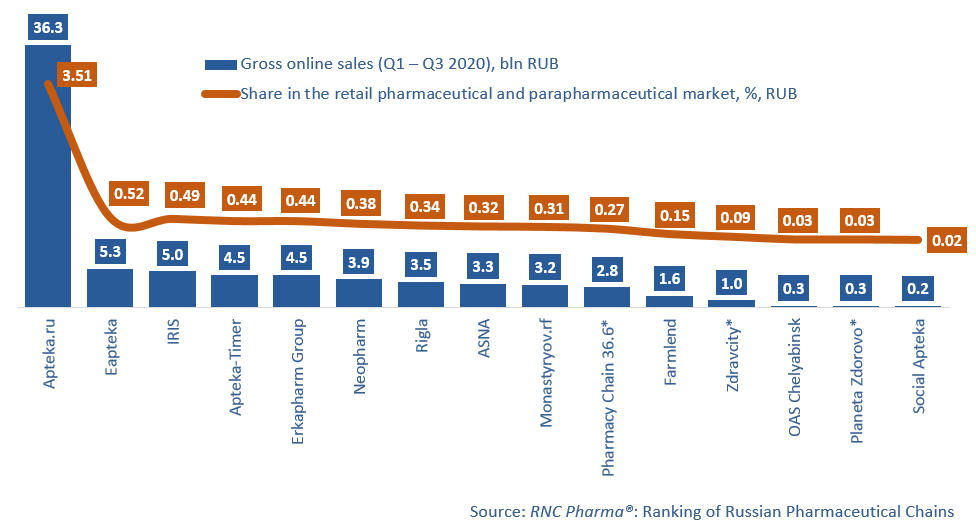

Top 15 Online Pharmaceutical Retailers in Russia (Q1 – Q3 2020)

Between January and September 2020, the total volume of online sales or reservation of medicinal products (pharmaceutical drugs and parapharmaceuticals) in Russia amounted to RUB 95.2 bln (end-user prices, VAT included), which is nearly 9.2% of the market volume. The e-commerce segment in this ranking is represented only by organizations selling medicinal products on a regular basis; these volumes do not include the revenue of gray online businesses supplying original drugs to Russia from other countries, as well as services selling generics unregistered in Russia.

In the analyzed period, the total sales volume of the top 15 companies amounted to RUB 74.8 bln (end-user prices, VAT included), which is 78.6% of the online pharmaceutical sales. Around 220 organizations, including websites of relatively small pharmacy chains or individual pharmacies, account for another RUB 20.4 bln. The total number of companies dealing with online sales was gradually growing in 2020, with a significant number of companies receiving permits to sell OTC drugs. However, many use only certain elements of online sale, in particular, product reservation, after which a customer picks up and pays for the product in a physical store.

Apteka.ru is still the absolute leader of the segment, with a turnover of RUB 36 bln, which is 3.5% of the market. The remaining 14 companies account together for 3.7%. However, even the largest companies’ business organization models differ significantly, as well as the profitability of their online sales. Moreover, the work of, say, Apteka.ru or Zdravcity, is quite difficult to analyze in isolation from the parent business. Eapteka comes second with RUB 5.3 bln, which is around 0.52% of the market. The deal, which made the organization part of the Sberbank ecosystem, created quite a stir, and now many expect from it not only scaling up the organization's activities, but also active lobbying of the interests of the emerging online pharmaceutical drug trade. In a sense, the current market restrictions greatly reduce the range of interested parties that could develop their online segment. Among those are not only the requirements for the number of pharmacies and the license duration, which complicates market access for large marketplaces, but also the ban on Rx drug sale, which is essential for the development of the online sphere by regional pharmacy chains.

The top 15 also includes the online segment of ASNA, which in late 2020 attracted an investor: Gazprombank became the owner of a minority stake in the company. The bank's interests were obviously dictated by other motives, and the Internet segment still plays a relatively modest role in the ASNA business model.

Тop 15 Russian online pharmaceutical retailers (Q1 – Q3)*

Рус

Рус