Database Update: Audit of Veterinary Drug Retail Sales on Russian Online Marketplaces (November 2021)

In January–November 2021, the retail sales of veterinary drugs through the top online marketplaces in Russia amounted to 673.3 million rubles (retail prices, VAT included), having increased 3.2 times from January–November 2020. The sales through marketplaces accounted for 3.5% of the total veterinary retail sales against 1.2% in January–November 2020. In physical terms, the sales declined 2.7 times from 2020, if calculated in minimum dosage units (MDU). The sales volume was 4.7 million MDUs.

Demand for veterinary drugs on marketplaces depend on the season just as much as demand in offline pharmacies. At the same time, given the rapid growth in online sales, the usual trends are not as prominent here. Last year, the monthly growth rates of sales had a stable upward trend without record-worthy figures, while this year a more or less standard surge in sales was evident in March–April 2021. Combined with the promotional activity of certain manufacturers, the result turned out to be outstanding, with the sales volume of veterinary drugs on marketplaces increasing 5.9 times in monetary terms from March–April 2020. That had a huge influence on further trends. However, marketplaces inevitably lure away consumers from the offline segment. It is obvious that the stagnation trends here are largely related to the demand migrating to a new, actively developing channel.

The total range of drugs sold online is still much more modest than that in the offline segment. In January–November 2021, only about 400 veterinary drugs were offered online against more than 1,200 offline. At the same time, the online segment does not seem to be wanting to drastically increase this figure, opting for taking the most profitable trademarks instead.

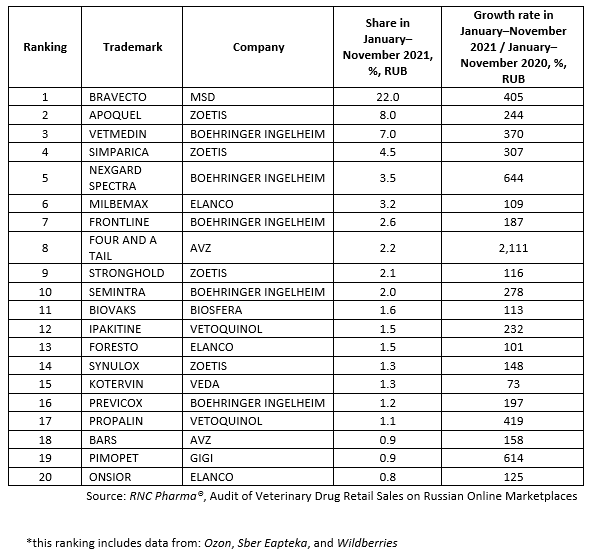

Among the top 20 trademarks with the largest sales volumes on marketplaces in January–November 2021, there was no trademark that showed a decrease in sales. Furthermore, almost all the 20 trademarks had multiple growth rates. The sales of Four and a Tail by Agrovetzashchita (AVZ) had the best growth rates (sales increased more than 22 times from 2020), with repellent collars and solutions for external use contributing to the growth rates the most.

Antiparasitic Nexgard Spectra by Boehringer Ingelheim also had high growth rates (sales increased 7.4 times), together with cardiotonic Pimopet by Gigi (7.1 times). Bravecto by MSD, which tops the offline ranking, tops the online ranking as well (sales grew 5 times). The top-2 drugs are different, however; here it is antipruritic Apoquel by Zoetis, which has not gone higher than top-9 in the offline segment.

Top 20 trademarks of veterinary drugs with the largest retail sales volumes on Russian online marketplaces* in January–November 2021

Рус

Рус