Vaccine Export from Russia in 2021

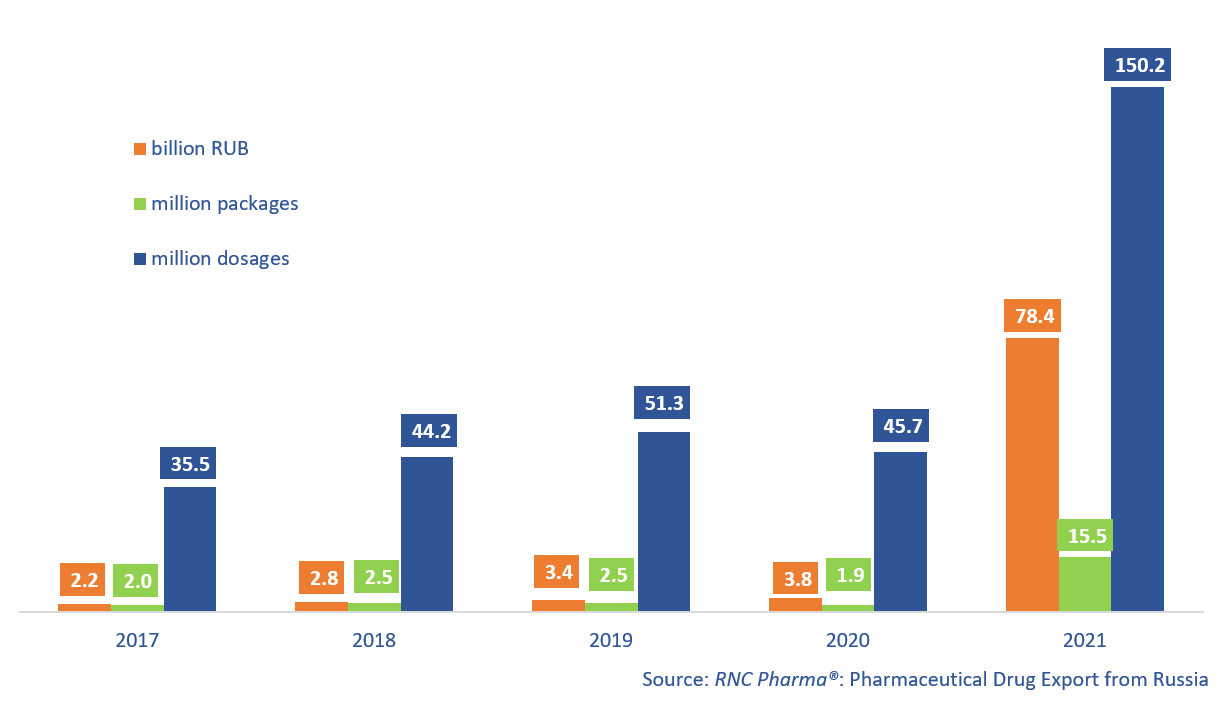

The export of pharmaceutical drugs from Russia in 2021 reached a new all-time high in both volume and growth rates. Most of the exported drugs were vaccines, a total of RUB 78.4 billion (customs duties included, EEU countries excluded). The export volume in monetary terms (rubles) increased almost 21 times compared to 2020, with the COVID vaccines contributing to the growth rates the most, as expected.

In physical terms, the export volume of vaccines was 15.5 million packages, or 150.2 million dosages. The export grew 8.3 times in packages and 3.3 times in dosages against 2020. The difference between the growth rates in monetary and physical terms could be explained by a significant price increase; the average price of a vaccine package in 2021 was RUB 5,057, 2.5 times more than a year earlier. The price per dosage increased 6.3 times, reaching RUB 522.

Russia exported 36 brands of vaccines, with the vaccines the prevention of COVID-19 placing first, second, and forth. The undisputed leader of the previous years, Vaccine for the Prevention of Yellow Fever by the Chumakov Institute, placed third. The export of the top-1 vaccine, Gam-COVID-Vac by the Gamaleya Research Institute of Epidemiology and Microbiology, was more than RUB 66.9 billion, 85.4% of the export in 2021 (EEU countries excluded). The total export volume of the Institute’s products is close to 90%, if the exports of Sputnik Light (top 4) are taken into account. R-Covey, manufactured under license from Oxford University and AstraZeneca by R-Pharm, quite unexpectedly placed second, accounting for 4.7% of the total vaccine exports. Interestingly, the export began as late as April 2021. The registration procedure for the drug started at the beginning of 2022, which means the vaccine is yet to be registered in Russia. Anti-influenza vaccines occupy a significant share in the exports (RUB 685 million, EEU countries excluded), in particular Grippol (Petrovax Pharm), Sovigripp (Microgen), and Ultrix (Nacimbio).

In 2021, Russia exported its vaccines to 76 countries, which is 32 more than in 2020. The countries Russia had never exported pharmaceutical drugs before took the top places in the ranking based on the export volume. Those are Mexico, the United Arab Emirates, Argentina, and the Philippines, all of which purchased Gam-COVID-Vac and, in the case of the Philippines, also Sputnik Light. These four countries accounted for nearly 60% of the exports in monetary terms in 2021.

The total number of buyers of Gam-COVID-Vac in 2021 was 46, and Sputnik Light was exported to 10 countries. R-Pharm had a large number of trade and economic partners as well; its R-Covey was exported to 9 countries, with Saudi Arabia, Kuwait, and Oman accounting for almost 93% of all exports of the vaccine.

Growth rates of the export of vaccines from Russia (EEU countries excluded) in 2017–2021, customs duties included

Рус

Рус