Database Update: Pharmaceutical Drug Production in Russia (November 2019)

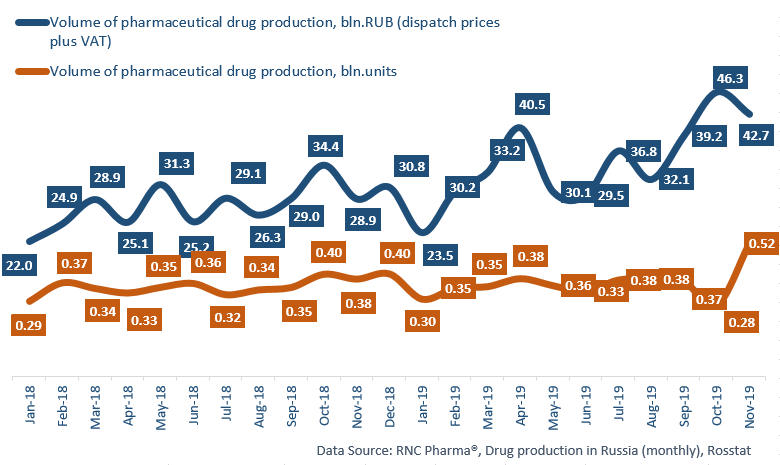

Between January and November 2019, Russia manufactured 383.9 bln RUB worth of pharmaceutical drugs (manufacturer’s prices, VAT included), which is in monetary terms (rubles) 25.8% higher than the production volume in 2018. In physical terms, the production volume is 4.1 bln units, or 67.2 bln minimum dosage units (MDU). The dynamics in physical terms are +6.5% in units and +5.3% in MDU.

As for the performance in November, the dynamics in both physical and monetary terms are rather high. The dynamics in monetary terms are +47.5%, which is the second best dynamics this year (the best dynamics were in April, +61%). In physical terms, the dynamics are +36%, which is the highest dynamics since January 2011.

The dynamics of the Rx drug production in physical terms are +17.1% for the period. While the dynamics of the OTC drug production are only +0.2%, it is the first time since April 2019 the dynamics have been positive.

Among the top 20 manufacturers of Rx drugs, Escom (Stavropol) has the highest dynamics, the company’s production volume has increased by 2.8 times in physical terms. Due to problems with the supplier of glass medical bottles in June 2018, the company had to stop production and resumed it only in April 2019, which makes the high dynamics seem like compensatory growth. Their key product is IV solution Sodium Chloride accounted for more than 61% of the company’s production and contributed to the dynamics the most. Escom is followed by Gedeon Richter with the dynamics in physical terms of 64%. Their key product is Verospiron, accounting for nearly 47% of the total production. The production of Verospiron has grown by 4.8 times.

Ivanovo Pharmaceutical Plant and Samaramedprom still have the highest dynamics among the top 20 OTC drug manufacturers, with +60% and 40%, respectively. The drugs that contributed to the dynamics of Ivanovo Pharmaceutical Plant are Sodium Tetraborate (production increased by 10 times), Ammonia (by 4.6 times), and Castor Oil (by 4 times). For Samaramedprom, it was Pertussinum (by 5.4 times) and Vaseline (by 4.5 times).

Read more about pharmaceutical drug production in Russia (November 2019) here: http://www.rncph.com/news/06_12_2019

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2018 – November 2019)

Рус

Рус