Database Update: Pharmaceutical Drug Production in Russia (March 2019)

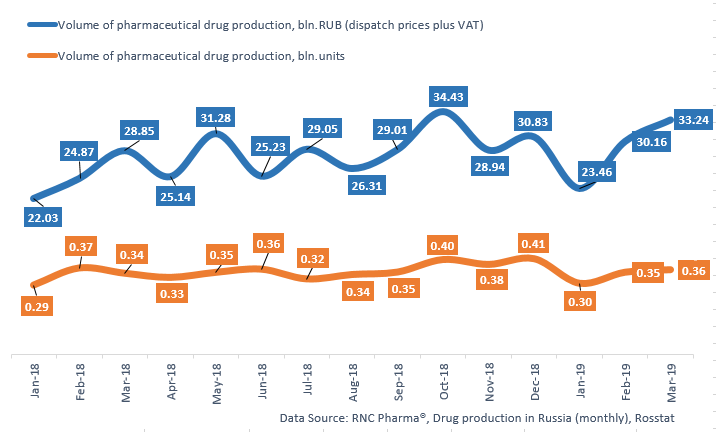

Between January and March 2019, Russia produced 86.9 bln RUB worth of pharmaceuticals (manufactures’ dispatch prices, VAT included), which is in monetary terms 14.7% higher than that of the same period of 2018. However, the dynamics in physical terms are only +0.5% (1.01 bln units).

March 2019 saw not only the highest production volume (0.36 bln units), but also the best dynamics (+4.3%). The March results also contributed a lot to the dynamics for the analyzed period. If calculated in minimum dosage units (MDU), the dynamics for the period are +1.2%.

Keeping up with this year’s tendencies, the dynamics of the Rx drug production for the period are +8.3%, while those of the OTC drug production are -4.5%. Among the top 10 Rx drug manufacturers with the highest growth, Groteks is the leader, with +49% in physical terms. Between January and March 2019, it mainly produced Sodium Chloride (44% of the company’s production), Lidocaine (6%), Novocaine (5%), and Glucose (5%). Pharmstandard follows with +45%; over the period, it focused on Combilipen (15%), Phosphogliv (10%), Picamilon (9%), and Formetine (8%).

Among the top OTC drug manufacturers, Samaramedprom remains the leader, with a 2.5 times increase. Its Formic Alcohol (17% of the company’s production), Menovazin (15%), Iodine (12%), and Sodium Borate (12%) contributed to the dynamics the most. Pharmstandard places second yet again with +42%; its Citramon (10%), Activated Carbon (9%), Rinostop (9%), and Corvalol (8%) contributed to the dynamics.

Read more about pharmaceutical drug production in Russia (February 2019) here: http://www.rncph.com/news/28_03_2019

Dynamics of pharmaceutical drug production in Russia, including production of pharmaceuticals of foreign companies on owned or contract plants, in physical (units) and monetary terms (RUB, VAT included) (January 2018 – March 2019)

Рус

Рус